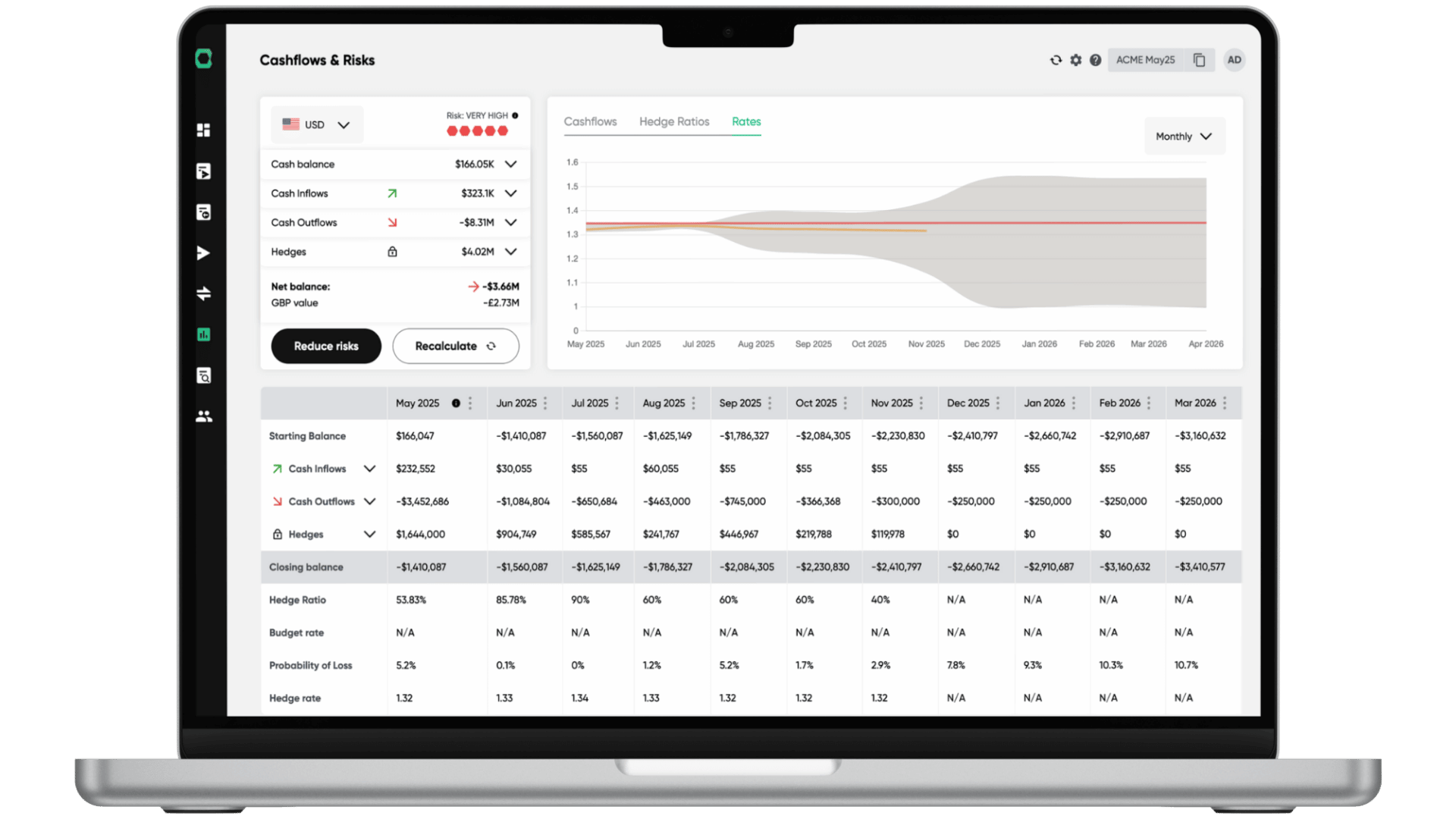

Most finance teams manage currency risk like driving in fog - they know something's out there, but can't see how big or how close.

Let your facts, not market moves and emotions, drive your financial decisions.

Connect your ERP, forecasting tools, or CRM in minutes to get real-time visibility into your actual currency exposures.

No more guessing what your risk looks like - see it as it happens.

Transform your raw data into clear risk insights.

See exactly how much FX exposure you're carrying, what it means for your business, and when you should be concerned.

Implement hedging policy, get expert recommendations, then execute them easily.

Embed them in your workflows and systems to manage treasury in 35 currencies.

No more nasty surprises. Connect your data, let us know your risk tolerance, and HedgeFlows will automatically monitor and alert you before it’s too late to act.

Go beyond the FX ‘budget buffer’ on projects. Gain critical early visibility of your entire pipeline and currency needs, including projected cash flows through integrations with software like NetSuite & HubSpot, and stay one step ahead.

Connect your accounting, ERP, FP&A and other tools and see and quantify your risks as soon as they arise.

FX HEDGING WORKFLOWS

Easily execute risk management best practices with help from our experts and guidance from our especially-trained AI – Currency Co-pilot.

EXPERT IN-PERSON GUIDANCE

Get a free upfront consultation with our experts to discuss risk and plan an FX risk management process that’s right for the industry, size and specific needs of your business.

Then use our intuitive tools and workflows to implement it.

Download a complimentary and customizable FX hedging policy template designed for Finance and Treasury teams.

This document encompasses objectives, FX products, strategies, controls, monitoring, and more. Easily tailor it to meet your unique needs, or contact our team for more assistance.

Book a free consultation with our experts to discuss your FX risks and help you formulate clear objectives.

Connect your accounting or ERP system in MINUTES for real-time visibility and alerts.

Our intuitive guides and support from experts help you configure hedging strategies, alerts and reports.

HedgeFlows is an FCA-regulated institution that processes millions in currency payments and transactions every day. We treat your data with the utmost care and protect it from cyber threats and unauthorised access with role-based access controls and multi-factor authentication.

"Winner of Best Business Finance Solutions Provider" - SME Enterprise Awards 2023

"Winner of Best Innovation" - Best Business Awards 2023