Premium Travel Brand

Streamlining finance processes for a travel agency

"It definitely saves us time, having completely removed the need to manually track hedges, and the annoyance of setting up payments in the bank'".

FINANCE MANAGER

Maximising efficiency in the travel industry: overcoming growing pains

A premium travel brand sought assistance from HedgeFlows to optimise their invoice payment and reconciliaton processes in the wake of a post-pandemic growth rebound. As their transactional portfolio expanded, the company faced challenges in maintaining adequate hedges, resulting in significant foreign exchange (FX) losses. By leveraging HedgeFlows' expertise and implementing innovative solutions, the travel brand successfully automated micro-hedging and payments, leading to remarkable improvements in efficiency and profitability.

Streamlining invoice payments and reconciliations

.webp?width=3000&height=1856&name=Untitled%20(480%20%C3%97%20297mm).webp)

To address the client's pain points, HedgeFlows seamlessly integrated with Xero, enabling the accounts team to streamline the entire invoice approval and payment process across seven currencies. This integration offered a comprehensive view of travel bookings, allowing for real-time hedging decisions to individual invoices. This process eliminated the need for intermittent and error-prone manual hedging, resulting in substantial time and cost savings for the company.

SYSTEM USED:

A FLEXIBLE SOLUTION

Saved time: with the implementation of HedgeFlows, the travel brand saved approximately 50 days per year that were previously spent on manual hedging, payments, and reconciliations. The accounts team could redirect their efforts toward more strategic tasks, contributing to increased productivity and overall operational efficiency.

Accelerated international approvals: the integration between HedgeFlows and Xero empowered the travel brand to expedite international approvals fivefold. The streamlined processes significantly reduced approval cycles, ensuring faster payment execution and enhancing customer satisfaction. The ability to process transactions rapidly in multiple currencies also strengthened the brand's position in the global travel market.

Mitigating Foreign Exchange (FX) risks: In addition to automating invoice payments and reconciliations , HedgeFlows' solutions enabled the travel brand to effectively manage their FX exposure and minimise losses resulting from unfavourable currency fluctuations.

Marging error reduction: by removing the FX impact, the company achieved an impressive 92% reduction in margin errors. The automated hedging system accurately calculated currency conversions and adjusted rates, ensuring that the travel brand maintained profitability across its transactional portfolio.

EXTENDED BENEFITS

INCREASED PROFITABILITY

The seamless integration of HedgeFlows with the travel brand's existing system (Xero) not only optimised operational efficiency but also enhanced profitability. The reduction in FX losses, coupled with the elimination of margin errors, directly contributed to increased profit margins and financial stability.

IMPROVED RISK MANAGEMENT

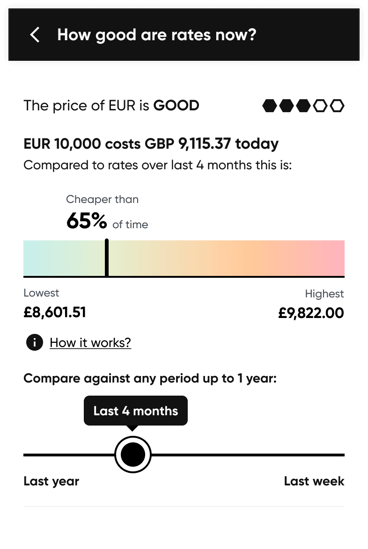

HedgeFlows' automated micro-hedging capabilities provided the travel brand with comprehensive risk management solutions. The real-time visibility into hedging decisions and accurate currency conversions allowed the company to proactively address potential risks, protecting their bottom line from adverse market conditions.

ENHANCED DEICISION-MAKING

By leveraging HedgeFlows' intuitive analytics and reporting features, the travel brand gained valuable insights into their transactional portfolio. Armed with data-driven information, they could make informed decisions regarding hedging strategies, and cash flow management.