HedgeFlows for Xero

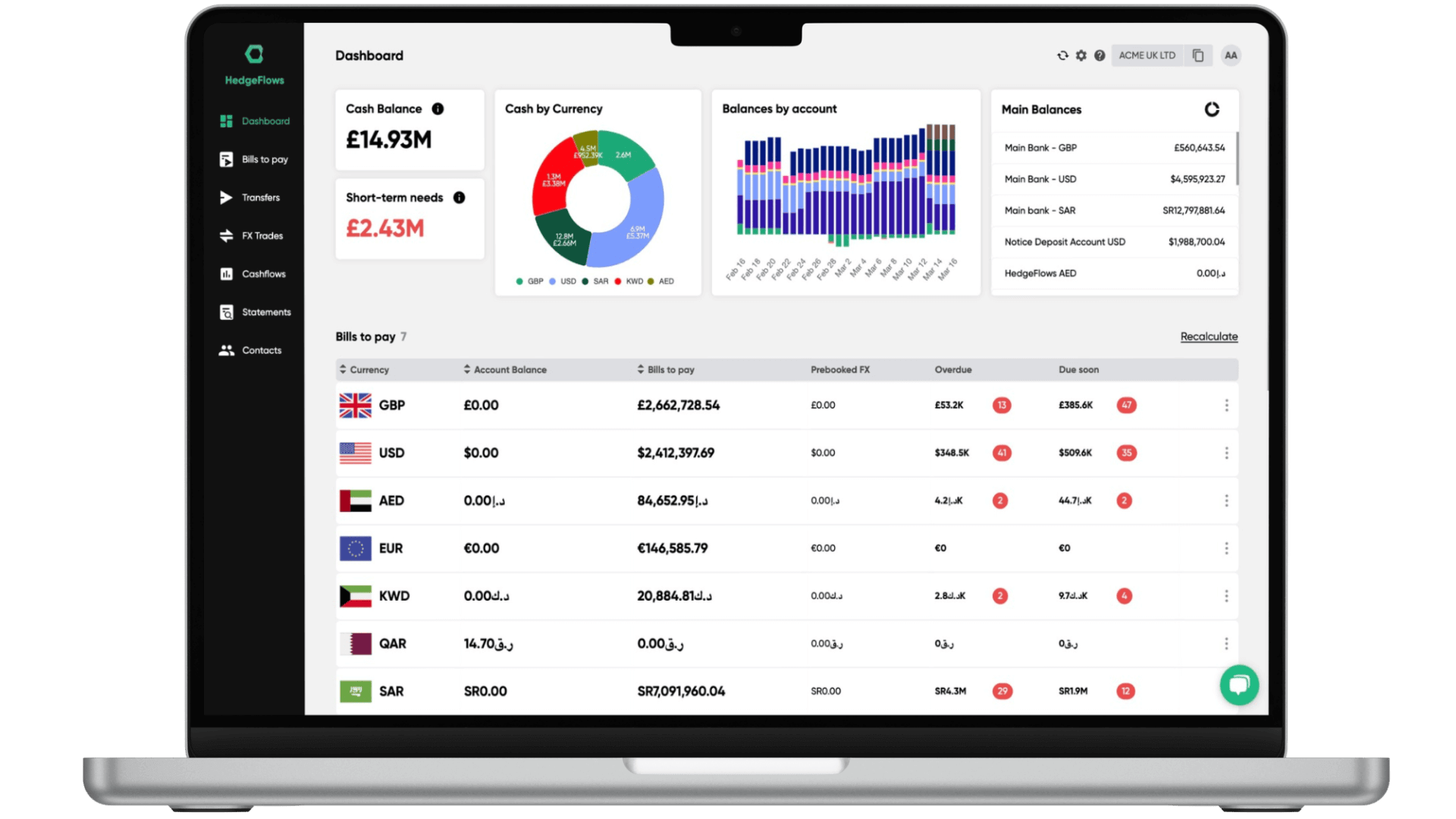

From bulk payments in 35 currencies to multi-entity cash and FX risk management, HedgeFlows helps you go global with Xero – in one go.

Pay in bulk in up to 35 currencies and 185 countries and we auto-reconcile payment to invoices in real time

Easily see and manage currency risks before they turn into surprise losses. Effortlessly plan your cash flows in multiple currencies

Consistently rated 5* as the best multi-currency app for payment and cash management by Xero users

"streamlining a very manual process"

"pleasing on the eye and incredibly easy to use"

"makes the harder parts feel easy"

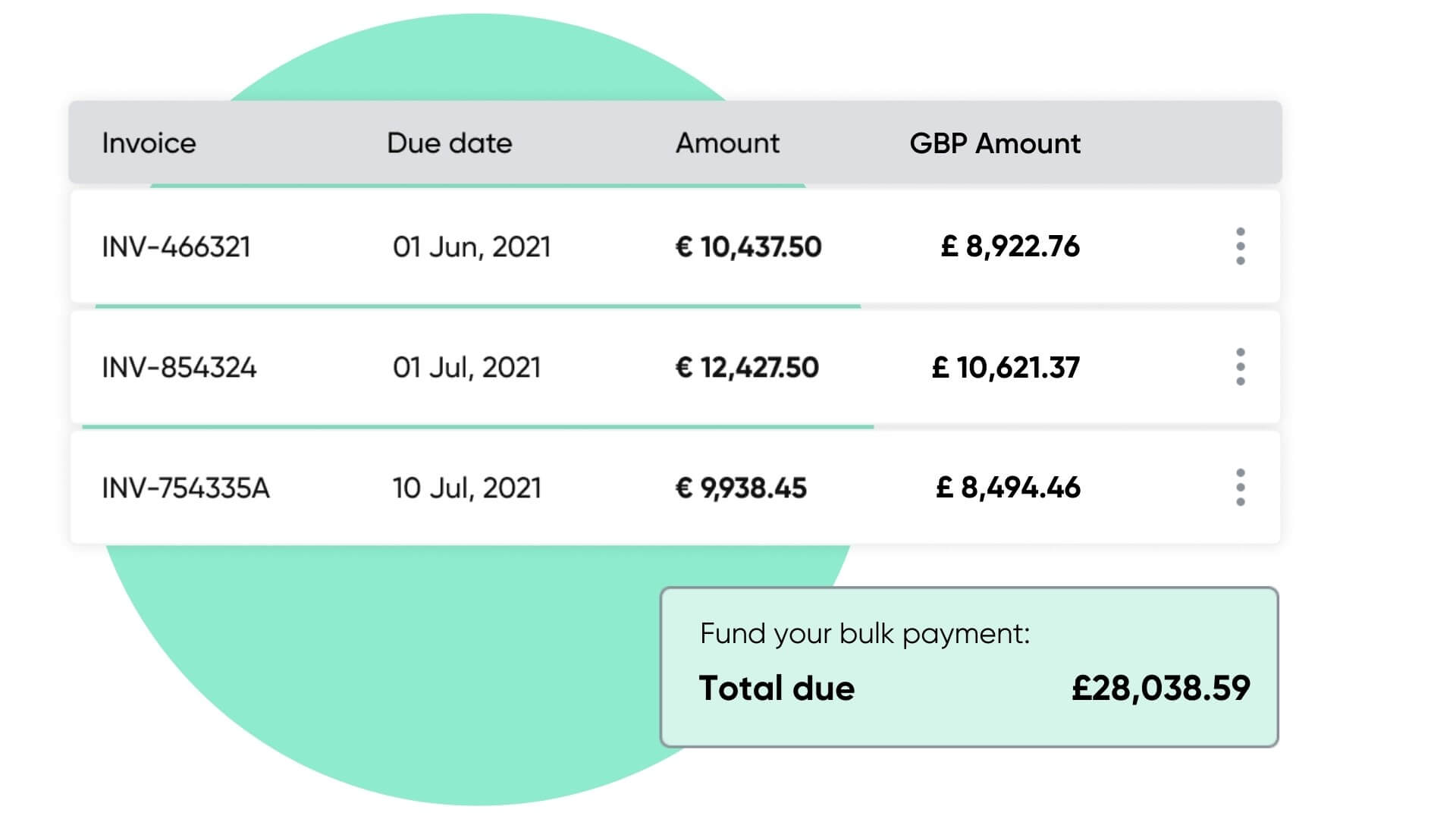

Paying numerous invoices in multiple currencies can be challenging in Xero.

HedgeFlows is the simplest way to process Xero batch payments in any currency, create foreign currency payment runs, with or without an approval process, fund it easily from your bank account, and automatically mark invoices as paid in your multi-currency Xero account.

Discover how Xero's intuitive system seamlessly integrate with HedgeFlows.

Find out how simple it is to process payments and invoices in multiple currencies using HedgeFlows.

If you'd like to see a personalised demo or start giving it a go, you can book some time to speak to us or sign up for a free trial.

Banks and other providers overcharge growing businesses such as Xero users for foreign payment and conversions. HedgeFlows helps you compete internationally and manage finances better. Our platform is a uniquely simple, effective way for growing businesses to reduce currency costs and improve cash visibility and planning in any currency.

Our subscription includes a free monthly allowance for local payments in GBP, USD and EUR.

Pay just 0.25% markup above the interbank exchange rate. Without any surprises.

Our clients save up to 80% of their time spent on payment runs when they use HedgeFlows.

From transforming how you manage bulk payments & cashflows in Xero:

Sign up for free using your email address at app.hedgeflows.com/sign-up.

Optionally, connect your accounting system to get the most out of HedgeFlows.

Register your business to start managing foreign finances with HedgeFlows.

"Being able to pull the invoices and just pay them directly with HedgeFlows is great. It's not a challenge anymore. Feeding invoices back to Xero; I didn't know that was even a challenge, and now you guys do it for me!".

ALICE, JBM FREIGHT.

Xero is the world-leading online accounting software built for small businesses.

Find out more or try Xero Accounting Software for free.

Indeed, HedgeFlows makes paying invoices from Xero easy and faultless. Once invoices are approved in Xero they will appear in your HedgeFlows account integrated with Xero, and you can simply choose the list of invoices you wish to pay. You can fund your payment run from your trusted bank account, and we automatically process currency conversions, make correct transfers, send remittance emails and reconcile back to Xero for you!

Yes, HedgeFlows offers a customisable approval process with individual roles and limits to support your payment run needs.

Of course, we are working with the leading accountancy practices in the UK already and are helping make foreign currencies simpler for thousands of small businesses in the country. You keep control of the validation of foreign payments, while your accountant takes care of processing the invoices, cash management, and accounting tasks.