International business payments

Pay internationally with the most transparent and competitive currency charges in the market.

"Worked tirelessly to give us good exchange rates"

" More cost-effective than any previous payment method we have used."

Transparent, competitive currency costs

Not every business cares about currency costs, but if you do business internationally, you should. Our goal is to keep transaction fees fair & transparent.

We are upfront about currency markups.

Banks and Card processors still don't like talking about currency charges. We do so upfront as we treasure your time:

You pay just 0.25% - 0.4% markup above the interbank exchange rate to convert currencies - Agreed upfront when you open AN Account. That's it, no surprises.

Create an account to see our live rates - it takes less than a minute.

Typical conversion charges compared:

| HedgeFlows | 0.25% - 0.40% |

| PayPal | 3%+ |

| Credit Cards | 1.8 - 3.5% |

| Leading UK Banks | up to 2.60% |

| Currency Brokers | up to 1.00% |

Read our Top 5 MONEY-SAVING TIPS FOR INTERNATIONAL TRADE AND PAYMENTS

Regain control with a choice of international payment options

We give you choice: Free local payments & affordable SWIFT transfers

Local payments

Leverage your multi-currency account for fast or real-time local payments.

- Pounds Sterling - Faster Payments

- Euro and other SEPA currencies - SEPA

- US Dollar - ACH

- 👍 Completed same or next business day

- 👎 Not always possible to recall if a mistake is made

- 👎 No payment tracking

SWIFT transfers (SHA)

Send funds in 37 currencies via a global network of correspondent banks.

- Available for 37 currencies

- Usually same or next day but can take up to 5 days

- 👍 MT103 confirmation included online

- 👍 Real-time tracking to improve visibiity

- 👎 Correspondent banks charge fees that are deducted from your transfer amount

SWIFT transfers (OUR)

Send funds to 120 countries with all correspondent bank charges covered.

- Available for most currencies

- Usually same or next day but can take up to 5 days

- 👍 MT103 confirmation included online

- 👍 Real-time tracking to improve visibiity

- 👎 You pay a higher payment fee to protect from surprise correspondent bank charges

Easy tools that save your business time

Tired of annoying FX broker phone calls, tacky banking apps, or complex trading platforms?

We've got tools built for small business owners and their finance teams to keep international finances simple:

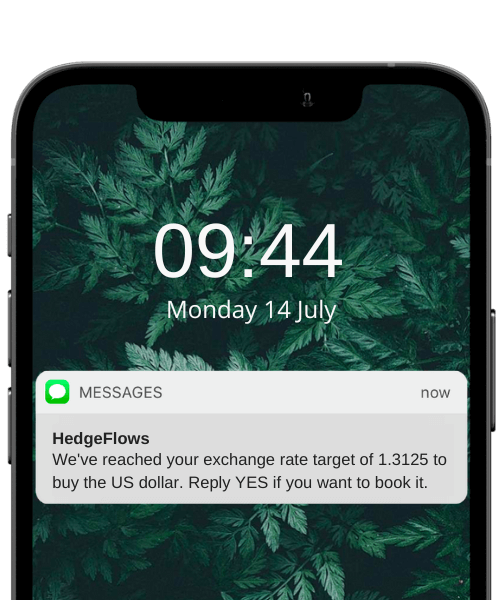

Timely alerts - when and how you want them.

Whether it is an exchange rate level, or payment status update, we can notify you when and how you want us to; online, by email, or on your phone.

Fix guaranteed exchange rates up to 12 months in advance.

Do you want to protect your costs from currency volatility? Or fix the exchange rate that works for your profit margins? Our currency pre-booking tool is the simplest way to book guaranteed exchange rates up to 12 months in advance. No security deposit is required.